Effects of Bad Credit History on Your Home Loan

Having a bad credit history can significantly impact your ability to get a home loan and can also affect the terms and conditions of the loan. Lenders use credit history to assess the risk associated with lending money to a borrower. Here are some of the effects of bad credit history on your home loan:

Difficulty in Loan Approval: With a bad credit history, you may find it challenging to get approved for a home loan. Lenders are more hesitant to lend money to individuals with a history of late payments, defaults, or bankruptcies as it indicates a higher risk of defaulting on the loan.

Higher Interest Rates: If you manage to get approved for a home loan with bad credit, you are likely to be offered higher interest rates. Lenders compensate for the increased risk by charging borrowers with poor credit scores more in interest.

Larger Down Payment Requirement: Some lenders may require you to make a larger down payment if you have bad credit. A larger down payment can act as a buffer for the lender in case of default.

Limited Loan Options: With bad credit, you may have fewer loan options available to you. You might be limited to subprime lenders who specialize in lending to borrowers with poor credit, but they often come with higher interest rates and less favorable terms.

Private Mortgage Insurance (PMI): If you put down a smaller down payment, your lender may require you to pay for private mortgage insurance (PMI). PMI protects the lender in case of default and adds an additional cost to your monthly mortgage payment.

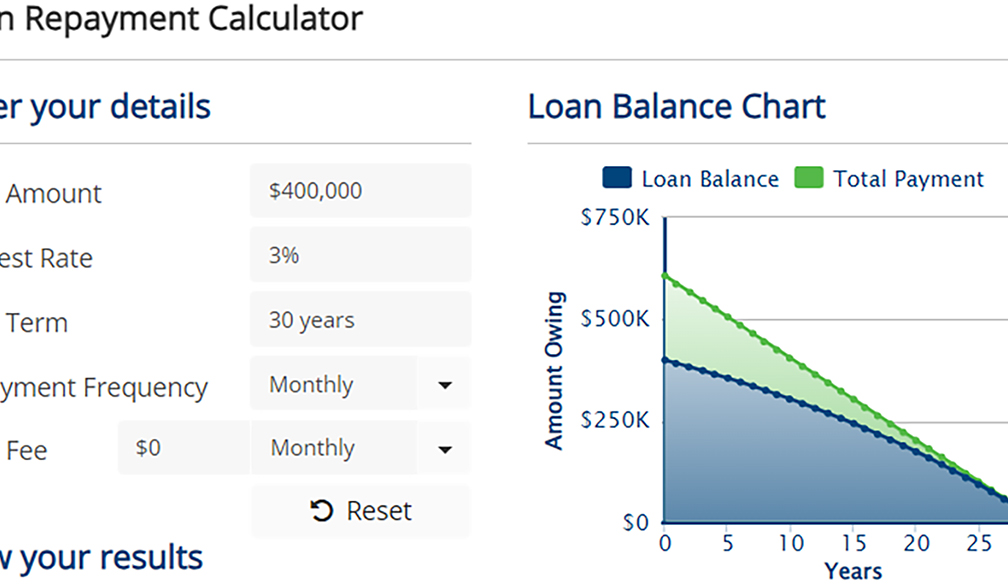

Shorter Loan Terms: Lenders may offer shorter loan terms for borrowers with bad credit. A shorter loan term means higher monthly payments but less overall interest paid over the life of the loan.

Rejection of Application: In some cases, a bad credit history might lead to outright rejection of your home loan application by certain lenders

It's important to note that the impact of bad credit on a home loan can vary depending on the lender and their specific criteria. While a bad credit history can make the process more challenging, it's not impossible to secure a home loan. Taking steps to improve your credit score over time can help you qualify for better loan terms and more favorable interest rates in the future. It's always a good idea to work on improving your credit before applying for a major loan like a mortgage.