What you need to know before getting a business car loan

You've decided that it's time to get a business car loan (also known as a chattel mortgage), but before you start shopping for the perfect vehicle, there are a few things you need to know. Here's what you need to consider before getting a business car loan.

1. How much can you afford?

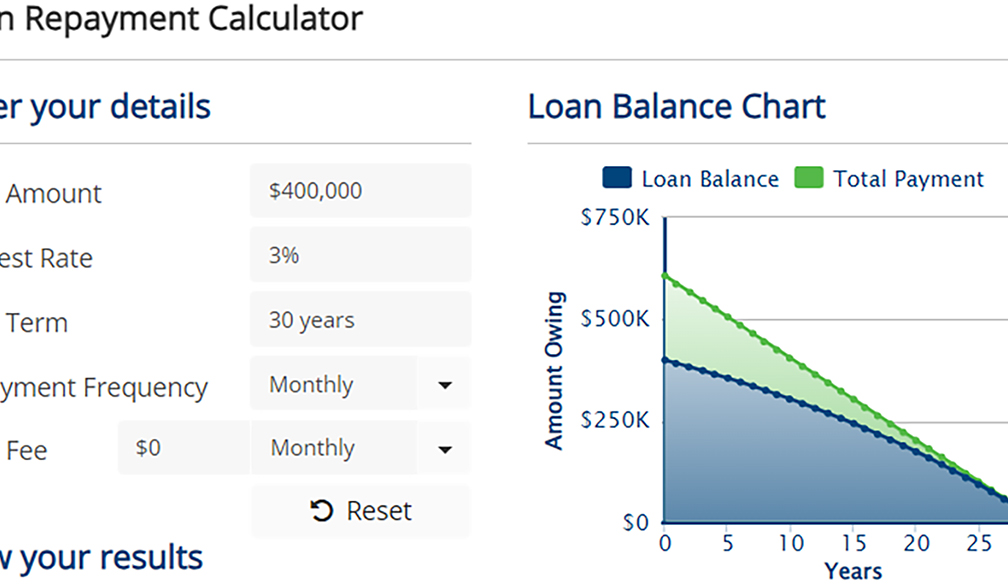

Before you start looking at cars, you need to know how much you can afford to spend. Take a close look at your budget and figure out how much you can realistically afford to put towards a car loan each month. This will help you narrow down your options and avoid getting in over your head.

2. What's the interest rate?

Interest rates on business car loans can vary widely, so it's important to shop around and compare rates before you make a decision. Be sure to ask about any special rates that may be available for qualified borrowers. There are a number of factors that can impact your interest rate including your credit score, the type of vehicle you're looking to purchase, and the length of the loan.

3. How long do you need the loan for?

The length of your loan will affect your monthly payments, as well as the total amount of interest you'll pay over the life of the loan. Generally, shorter loans have higher monthly payments but less interest overall. Longer loans have lower monthly payments but more interest overall. Choose a loan term that fits your budget and needs, and consider whether it's more important to you to pay less per month or less overall.

4. What are the fees?

Be sure to ask about any fees associated with the loan, including origination fees, prepayment penalties, and late payment fees. These can add up, so it's important to know what you're being charged before you agree to anything. Keen in mind that every lender will charge fees - the important thing is understanding them and factoring them into your lender decision.

5. What type of loan do you want?

Depending on your business situation and financial needs, there are several commercial car loans available for you to choose from. These include chattel mortgages (or a standard commercial car loan), hire purchase arrangements, ongoing leases and novated leases.

6. What's the process?

Finally, be sure to ask your lender about the process for getting a business car loan. Find out how long it will take to get approved and how long it will take to get the car. This will help you plan ahead and make sure everything goes smoothly.

Getting a business car loan is a big decision, but it doesn't have to be a difficult one. Just be sure to do your research and compare offers before you make a decision. With these tips in mind, you can find the perfect loan for your business needs.